We suggest you choose and contact Didi's 1040 & More as your Tax Return Preparer in Mira Mesa San Diego California. Affordable Professional Tax Preparation Services:

Individual Tax Returns, Small Business Tax Returns, S-Corp, C-Corp, Partnership & LLC.

Didi's 1040 & More

San Diego Mira Mesa Tax Services

San Diego Mira Mesa Tax Preparer

San Diego Mira Mesa Tax Professional

Mira Mesa Office Mall

10717 Camino Ruiz, Suite 101, San Diego, CA 92126

Call (858) 549-3434 Today

Learn more see website: www.DidiTax.com

What's New for FILING TAX What's New for FILING TAX

IRS Identity Fraud

Identity

theft, fraud and scams are high according to the Internal Revenue Service.

Should you receive notice from IRS or from someone representing they are from

the IRS please DO NOT provide any information to them until you have confirmed

they are legitimate. Remember the IRS does not initiate contact via email or

telephone. Their initial contact is usually a written notice. When in doubt,

ask for assistance.

Standard

Deductions & Exemptions 2017

The Basic standard deduction for 2017 is $12,700 for married persons filing

jointly and qualifying widows/widowers, $9,350 for heads of households, or

$6,350 for single taxpayers or married persons filing separately. The

additional standard deduction for being 65 or older or blind is $1,550. If

married filing jointly, the additional standard deduction is $1,250 if one

spouse is 65 or older or blind. Personal Exemption $4,050 and Kiddie Tax

Exemption $2,100.

Tax Rate Brackets 2017

The 10%, 15%, %25%, 28%, 33%, 35% and 39.6% brackets for 2017 ordinary income

reflect an inflation adjustment. The top bracket of 39.6% applies if taxable

income exceeds $418,400 for single taxpayers, $444,550 for head of households,

$470,700 for married persons filing jointly and qualifying widows/widowers, and

$235,350 for married taxpayers filing separate returns.

Wage Base & Earnings Limits 2017

Social Security Wages $127,200. Medicare Wages (1.45%) unlimited. Additional

Medicare: Wages 0.9% Investment 3.8%. Income over: $200,000 for Single and

$250,000 for Married. Social Security Earnings Limit Before Reductions: Under

retirement age $16,920, Year of retirement age $44,880. Note: Only for months

prior to attaining full retirement ($1 lost for every $2 over). Average Monthly

Social Security Benefits $1,360.

Earned Income Credit (EIC) 2017

For 2017, the maximum credit amount is $3,400 for one qualifying child, $5,616

for two qualifying children, $6,318 for three or more qualifying children, and

$510 for taxpayers who have no qualifying child. The phaseout ranges for the

credit have been adjusted for inflation.

Traditional IRA and Roth IRA Contribution 2017

For 2017, the contribution limit for traditional IRAs and Roth IRAs is

unchanged at $5,500, or $6,500 for those age 50 or older.

Retirement Limits 2017

For 2017, Defined Contribution Plans $54,000. Annual Gift Tax Limit $14,000 and

$28,000 for split gifts. SIMPLE $12,500 or $15,500 for those age 50 or older.

IRS Auto Mileage Rates 2017

The IRS standard business mileage rate for 2017 is 53.5 cents a mile. The rate

for medical care and moving expenses deductions is 17 cents a mile. For

charitable work, the mileage rate is unchanged at 14 cents a mile.

Children Credit 2017

For 2017, Adoption credit $13,570 and Child Tax Credit (CTC) $1,000 (Each).

Refundable CTC up to 15% of income above $3,000.

Section 179 For 2017

For 2017, Annual Expense Limit $510,000 and Property limit prior to phase-out

$2.030 Million.

See IRS publications

for additional information , clarification and confirmation.

Didi's 1040 & More

Mira Mesa Tax Services

Mira Mesa Tax Preparer

Mira Mesa Tax Professional

Mira Mesa Office Mall

10717 Camino Ruiz, Suite 101, San Diego, CA 92126

Call (858) 549-3434 Today

Learn more see website: www.DidiTax.com

We suggest you choose and contact Didi's 1040 & More as your Tax Return Preparer in Mira Mesa San Diego, California. Affordable Professional Tax Preparation Services. Individual Tax Returns. Small Business Tax Returns, S-Corp, C-Corp, Partnership & LLC.

What's New for 2016 TAX FILING 2016 What's New for 2016 TAX FILING 2016

Refund Delays 2016

If your 2016 tax return claims an Earned Income Tax Credit or the Additional

Child Tax Credit your refund will be held by IRS until February 15th.

This delay is being mandated by recent tax law changes because of the

proliferation of identity theft and fraudulent tax returns using taxpayer

information. This extra time will be used by the IRS to help prevent revenue

loss due to theft.

Those most impacted by this change are early tax return filers. If you

typically file early, do not delay filing your tax return because of this rule

change. Tax returns can still be processed. Only the refund is being delayed.

Filing early can help you avoid the bottleneck of tax refund processing. On

February 15th you will want to be at the front of the line to

receive your money. If you historically plan on receiving an early refund, you

will now need to plan for this delay.

Tax Filing Date Changes 2016

There are new tax filing deadlines effective for 2016 tax returns. Small

businesses that are organized as a partnership or limited liability companies

filing Form 1065 must file their tax return on or before March 15, 2017. This moves the required filing date

up one month versus last year. Year-end C Corporations filing is a month later.

The old filing date of March 15th is now moved to April 15th.

Annual reporting of foreign bank accounts moves from June 30th to

April 15th. This is FBAR Form 114.

Standard Deductions 2016

The Basic standard deduction for 2016 is $12,600 for married persons filing

jointly and qualifying widows/widowers, $9,300 for heads of households, or

$6,300 for single taxpayers or married persons filing separately. The

additional standard deduction for being 65 or older or blind is $1,550 if

single or head of household ($3,100 if 65 and blind). If married filing

jointly, the additional standard deduction is $1,250 if one spouse is 65 or

older or blind, $2,500 if both spouses are at least 65 (or one is 65 and blind,

or both are blind and under age 65).

Income Brackets For 2016 Tax Rates

The 10%, 15%, %25%, 28%, 33%, 35% and 39.6% brackets for 2016 ordinary income

reflect an inflation adjustment. The top bracket of 39.6% applies if taxable

income exceeds $415,050 for single taxpayers, $441,000 for head of households,

$466,950 for married persons filing jointly and qualifying widows/widowers, and

$233,475 for married taxpayers filing separate returns.

Personal Exemptions Phase-out 2016

Personal exemptions and itemized deductions are subject to a phase-out. Each

$4,050 personal exemption for 2016 is subject to a phase-out if adjusted

gross income (AGI) exceeds $311,300 if married filing jointly or qualifying

widow/widower, $285,350 if head of household, $259,400 if single, and $155,650

if married filing separately.

Mortgage Insurance Premium Deduction 2016

If your are required to pay Mortgage Insurance Premiums you may deduct them on

your 2016 tax return , but not in future years.

Tuition and Fees Deduction 2016

This popular deduction for up to $4,000 of qualified tuition and fees expires

in 2016.

No Taxable Income On Cancellation Of Debt 2016

For years there was an extended tax break for debt forgiveness related to home

mortgages. This program comes to an end in 2016.

IRS Mileage Allowance 2016

The IRS standard business mileage rate for 2016 is 54 cents a mile. The rate

for medical expenses and moving expenses deductions is 19 cents a mile. For

charitable volunteers, the mileage rate is unchanged at 14 cents a mile.

Earned Income Tax Credit 2016

For 2016, the maximum credit amount is $3,373 for one qualifying child, $5,572

for two qualifying children, $6,269 for three or more qualifying children, and

$506 for taxpayers who have no qualifying child. The phase-out ranges for the

credit have been adjusted for inflation.

Identity PIN 2016

Look for your Identity PIN. If you are among the millions who have been

impacted by IRS Identity theft you will receive a PIN from the IRS. This PIN is

your added security to ensure that would be thieves can not successfully

process a tax return using your private information. If you receive this IRS

notice do not throw it out. Last year the IRS mislabeled the form with the

wrong year. Those who accidentally threw it out then faced the hassle of

getting it replaced.

Didi's 1040 & More

Mira Mesa Tax Services

Mira Mesa Tax Preparer

Mira Mesa Tax Professional

Mira Mesa Office Mall

10717 Camino Ruiz, Suite 101, San Diego, CA 92126

Call (858) 549-3434 Today

Learn more see website: www.DidiTax.com

We suggest you choose and contact Didi's 1040 & More as your Tax Return Preparer in Mira Mesa San Diego, California. Affordable Professional Tax Preparation Services. Individual Tax Returns. Small Business Tax Returns, S-Corp, C-Corp, Partnership & LLC.

What's New for 2015 TAX FILING 2015 What's New for 2015 TAX FILING 2015

Standard Deductions 2015

The Basic standard deduction for 2015 is $12,600 for married persons filing jointly and qualifying widows/widowers, $9,250 for heads of households, or $6,300 for single taxpayers or married persons filing separately. The additional standard deduction for being 65 or older or blind is $1,550 if single or head of household ($3,100if 65 and blind). If married filing jointly, the additional standard deduction is $1,250 if one spouse is 65 or older or blind, $2,500 if both spouses are at least 65 (or one is 65 and blind, or both are blind and under age 65).

Tax Rate Brackets 2015

The 10%, 15%, %25%, 28%, 33%, 35% and 39.6% brackets for 2015 ordinary income reflect an inflation adjustment. The top bracket of 39.6% applies if taxable income exceeds $413,200 for single taxpayers, $439,000 for head of households, $464,850 for married persons filing jointly and qualifying widows/widowers, and $232,425 for married taxpayers filing separate returns.

Individual Health Care Mandate 2015

You are required to have minimum essential health coverage through an employer plan, a government program, or other plan, or pay a penalty, unless you are exempt from this requirement. The penalty amount for 2015 is the higher of 2% of household income above your filing threshold, or $325 per person in your household ($162.50 per dependent child under age 18), up to a maximum of $975.

Phaseout Of Personal Exemptions 2015

Personal exemptions and itemized deductions are subject to a phaseout. Each $4,000 personal exemption for 2015 is subject to a phaseout if adjusted gross income (AGI) exceeds $309,900 if married filing jointly or qualifying widow/widower, $284,050 if head of household, $258,250 if single, and $154,950 if married filing separately.

Mortgage Interest Limit For Unmarried Co-Owners 2015

An appeals court held that if unmarried individuals co-own a residence, each co-owner can deduct interest on acquisition debt of up to $1 million and home equity debt up to $100,000. This decision disagreed with the Tax Court and IRS view that the $1.1 million debt limit must be divided among the co-owners.

Basis Of Property Reported On Estate Tax Return 2015

Executors filing estate tax returns after July 31, 2015 must report the date-of-date value of property included in the gross estate to the IRS and to the heirs. The heirs will be subject to a penalty if on a later sale of the property, they claim a basis for the property that exceeds the amount that had been reported to the IRS by the executor.

Self-Employment Tax 2015

For 2015, the tax rate on the employee portion of Social Security is 6.2% on wages up to $118,500, so Social Security tax withholdings should not exceed $7,347. Medicare tax of 1.45% is withheld from all wages regardless of amount.

IRA and Roth IRA Contribution 2015

For 2015, the contribution limit for traditional IRAs and Roth IRAs is unchanged at $5,500, or $6,500 for those age 50 or older.

IRS Mileage Allowance 2015

The IRS standard business mileage rate for 2015 is 57.5 cents a mile. The rate for medical expenses and moving expenses deductions is 23 cents a mile. For charitable volunteers, the mileage rate is unchanged at 14 cents a mile.

Earned Income Tax Credit 2015

For 2015, the maximum credit amount is $3,359 for one qualifying child, $5,548 for two qualifying children, $6,242 for three or more qualifying children, and $503 for taxpayers who have no qualifying child. The phaseout ranges for the credit have been adjusted for inflation.

Didi's 1040 & More

San Diego Mira Mesa Tax Services

San Diego Mira Mesa Tax Preparer

San Diego Mira Mesa Tax Professional

Mira Mesa Office Mall

10717 Camino Ruiz, Suite 101, San Diego, CA 92126

Call (858) 549-3434 Today

Learn more see website: www.DidiTax.com

We suggest you choose and contact Didi's 1040 & More as your Tax Return Preparer in Mira Mesa San Diego, California. Affordable Professional Tax Preparation Services. Individual Tax Returns. Small Business Tax Returns, S-Corp, C-Corp, Partnership & LLC.

Didi's 1040 & More San Diego California

Tax Professional Alpine, Aviara, Boulevard, Bonsall, Bonita, Borrego Springs, Bay Park, Carmel Valley, Cardiff By the Sea, Speak Filipino Tax Preparer City Heights, Clairemont, Campo, Carmel Mountain Ranch, College Grove, Coronado Cays, Coronado Shores, Coronado Village, Crown Point, Camp Pendleton, Carlsbad, Mira Mesa Speak Filipino Tax Services Chula Vista, Del Cerro, Descanso, Del Mar, Dulzura, Downtown San Diego, El Cajon, Escondido, Elfin Forest, Encinitas, Encanto, East San Diego, Fallbrook, Guatay, Speak Filipino Enrolled Agent Hillcrest, Imperial Beach, Jacumba, Jamul, Julian, Kensington, Kearny Mesa, La Costa, La Jolla, Lakeside, Lemon Grove, Leucadia, Logan Heights, Mira Mesa Speak Filipino Tax Preparation Specialists Lake San Marcos, La Mesa, Linda Vista, Mission Beach, Middletown San Diego, Mission Hills, Speak Filipino Tax Preparer Mira Mesa, Miramar, Mount Helix, Mission Valley, Mission Village, Murrieta, National City, Normal Heights, North Park, Ocean Beach, Oceanside, Old Town, Pala, Pauma Valley, Mira Mesa Speak Filipino Tax Professional Pacific Beach, Paradise Hills, Point Loma, Palomar Mountain, Pine Valley, Poway, Potrero, Ramona, Ranchita, Rancho Bernardo, Speak Filipino Tax Services Rancho Penasquitos, Rancho San Diego, Rancho Santa Fe, Santa Luz, Solana Beach, Sabre Springs, San Carlos, San Clemente, Mira Mesa Speak Filipino Enrolled Agent San Diego, Serra Mesa, San Luis Rey, San Marcos, San Ysidro, Scripps Ranch, Santee, Spring Valley, Santa Ysabel, Talmadge, Tecate, Temecula, Torrey Highlands, Speak Filipino Tax Return Preparation Specialists Tierra Santa, University City, University Heights, Valley Center, Vista, Warner Springs, Filipino Po Tayo - Tawag Na, Pilipino, Tagalog, Ilocano, Ibanag.

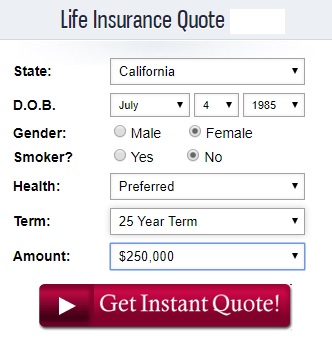

Get FREE Quotes

Compare Life Insurance Rates

Term Life Insurance or Permanent Insurance

Switch and Save Money

LEARN MORE

|

|

|

|

|